Peter saves £370 a year from his Green Home Improvements!

- Solar PV

- Triple glazed windows with insulated frames

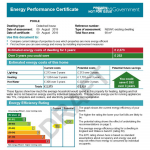

- EPC prior to improvements

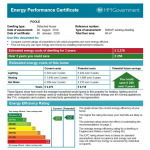

- EPC Rating after energy efficiency improvements

- Scaffolding required

- Permeable resin driveway

Peter’s fixed rate mortgage came up for renewal in July 2019, as part of the process of investigating new rates for the remortgage, he was also keen to make further energy efficiency improvments to his home.

Peter firstly spoke with his local mortgage broker ‘Cherry Mortgage and Finance’ to determine which lenders might look favourably on borrowers looking to make green upgrades. Due to the brokers experience looking at similar cases, he knew which lenders to approach first and who could offer their best rates for additional borrowing.

The Measures

Once a lender was identified, Peter started obtaining quotes for the works he was interested in, these were:

- Solar PV – 4.76kW peak system

- Triple glazed windows with insulated frames – 5 windows

- Permeable resin driveway (no surface run off)

- New sustainable timber gate

Other measures considered were:

- Car charging point – was unable to obtain a £500 grant towards a cost of £850 and not yet having an electric vehicle, Peter decided to put this aside.

- Tesla Powerwall – at a cost of £8000 this was over budget.

- Solar PVT – a mixture of PV with a thermal panel behind – again, budgets would not allow. Also the technology and how a system works best together in terms of thermal store/heat pump etc, is still to be further developed for successful domestic use.

The Costs

The total amount this added to Peter’s mortgage for all the work, bearing in mind the driveway is 75M2 alone and costs £10k, was £23,000. To maintain his current repayment mortgage term at 16 years, Peter’s mortgage on the same deal without the added £23,000, would have gone down from £897 a month to £865 a month (5-year fixed rate). With the improvements being tagged onto the mortgage, it is now £925 per month.

Everyone will have their own ideas of what they can afford, and whether they can overpay on the mortgage at some point to reduce costs further, but for Peter, it was the best way to borrow this amount and acheive the next range of property improvements he wanted to do.

The hope is the improvements will:

- Reduce property running costs (electric and gas bills, maintenance of drive/windows, both of which were quite old!)

- Improve the green credentials – lower CO2 emissions from property

- Improve the Energy Rating – Energy Performance Certificate D to B

- Increase the value of the property – average 14% increase according to Government average figures, if the correct improvements are made, the property has kerb appeal, and is in the right area too!

The EPC Rating

The Government has got its eye firmly fixed on the private rented sector currently when it comes to minimum EPC standards, but they have been moving discussions toward ensuring all owner occupier property is also up to a minimum ‘C’ rating where practical, by 2030 or soon after.

As the EPC is one of the only official ways to get an idea of a property’s energy use and environmental attributes at present, Peter had a before and after EPC carried out. Before improvements were made, the rating was a D68 which was already only 1 point off the ‘C’ band. After the relevant improvements of the new triple glazing and solar panels, the rating went up to a high B89, which is 3 points shy of an A rating. The only way to improve this further currently, according to the EPC, is to carry out underfloor insulation and to add solar hot water heating. Something to consider next time!

The Benefits

Factoring in all the benefits of the work, on an annual basis with bill savings, the new export tariff payment at 5.5p per KwH from Ovo Energy, and some reduction in maintenance costs each year, the financial payment is circa £370 per year, against £11,000 of investment for the 2 measures, per year, at current/gas electric prices – we all know those prices will go up!

With an end to gas and electricity subsidies in sight, and a possible move to a model of ‘polluter pays’ which could be levied through the Council Tax most likely, Peter has decided to start future proofing his property.

How we can help?

If you want to know more about what Ridgewater Energy can do to advise you on what can be done, and what its network of contractors are able to offer, as well as the current subsidies available and contacts to help with finance, please call us on 01202 862717 or visit the Green Home Improvement Network page.